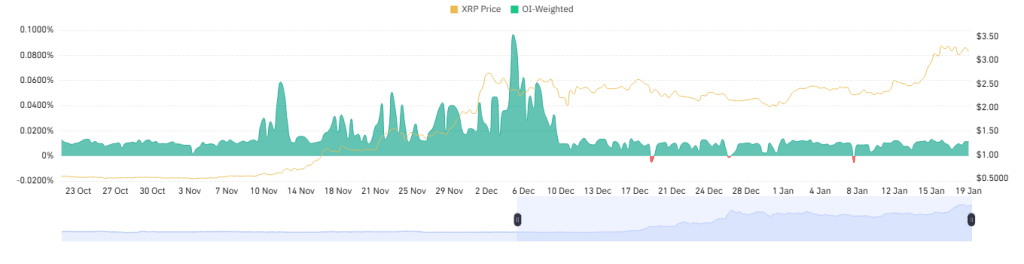

Recently, XRP surged to a 7-year high in the cryptocurrency market, demonstrating strong momentum. As of January 19, 2025, XRP is trading at approximately $3.12, reflecting significant growth over the past year. This article examines XRP’s price surge, the potential risks if it reaches $15 by mid-2025, and how Bitcoin and Ethereum influence its performance.

Factors Driving XRP’s Recent Price Surge

XRP’s price rise is fueled by several critical factors that have created a bullish sentiment in the market:

Key Drivers:

- Regulatory Optimism

- The political shift in the U.S., with Donald Trump’s administration expected to adopt crypto-friendly policies, has boosted investor confidence.

- Ripple Labs’ recent legal victories and regulatory clarity have further strengthened XRP’s position.

- Institutional Adoption

- Increased interest from institutional investors, including potential approval of XRP-focused ETFs, has driven demand.

- High-value transactions and wallet activity indicate growing institutional participation.

- Whale Accumulation

- Large investors (whales) have been actively accumulating XRP tokens, creating artificial demand and increasing prices.

- Market Sentiment

- A bullish cryptocurrency market has encouraged investors to explore altcoins like XRP as Bitcoin and Ethereum consolidate at high levels.

- Technological Advancements

- Ripple Labs continues to innovate, developing new products like RLUSD (its stablecoin) and forming partnerships that enhance XRP’s utility in financial systems.

Potential Risks if XRP Reaches $15 by June 2025

While reaching $15 would be a milestone for XRP, several risks could hinder its sustainability:

| Risk Factor | Description |

|---|---|

| Regulatory Scrutiny | A rapid price increase might trigger investors to take profit, leading to sharp corrections. |

| Market Volatility | A rapid price increase might trigger profit-taking by investors, leading to sharp corrections. |

| Technical Patterns | Bearish technical indicators could signal potential reversals in price trends. |

| Competition from Other Cryptos | Emerging blockchain projects or cryptocurrencies may challenge XRP’s market position. |

| Economic Conditions | Broader economic downturns or reduced risk appetite could decrease investment in cryptocurrencies. |

How Bitcoin and Ethereum Influence XRP’s Price

Bitcoin (BTC) and Ethereum (ETH), as dominant players in the cryptocurrency market, significantly impact XRP’s performance:

Key Influences:

- Market Sentiment

- Bitcoin often sets the tone for the entire cryptocurrency market; its rallies boost confidence in altcoins like XRP.

- Capital Flows

- During bullish periods for BTC and ETH, investors often diversify into altcoins such as XRP to maximize returns.

- Competitive Dynamics

- If XRP gains traction against Ethereum (e.g., through broader adoption or higher transaction volumes), this could create a competitive dynamic that influences the prices of both assets.

- Technical Correlations

- BTC and ETH movements often create technical patterns traders use to predict price trends for altcoins like XRP.

- Regulatory Comparisons

- Regulatory clarity for BTC and ETH may attract more institutional investment than XRP if Ripple’s legal challenges persist.

XRP’s recent surge reflects regulatory optimism, institutional adoption, whale activity, favourable market sentiment, and technological innovation by Ripple Labs. However, potential risks such as regulatory scrutiny, market volatility, and competition from other cryptocurrencies remain critical factors to watch if XRP aims to reach $15 by June 2025. Moreover, Bitcoin and Ethereum will continue to play a pivotal role in shaping market sentiment and influencing capital flows into altcoins like XRP. Investors should stay informed about these dynamics while navigating the evolving cryptocurrency landscape. If you can provide specific details from your source or additional context, I can refine this article further!